Physician Loans: Your Path to Easy Homeownership

Pursuing a medical career is a journey that requires years of dedication, rigorous training, and a desire to make a difference. Along the way, the dream of owning a home may seem out of reach, but with the right tools and information, it’s entirely possible. For medical residents transitioning into homeownership, physician loans are designed to simplify the process and align with their unique financial circumstances. This guide explores how these specialized mortgage solutions can make your homeownership goals a reality.

What Are Physician Loans?

Physician loans are tailored mortgage solutions created to address the specific needs of medical professionals. Unlike conventional loans, they take into account the financial challenges often faced by residents, such as significant student loan debt and a limited credit history. Physician loans typically offer lower down payment options—sometimes as little as zero percent—and flexible income verification processes. These features provide a practical path to homeownership for medical residents and early-career physicians.

Why Choose a Physician Loan?

Physician loans offer numerous advantages for medical professionals:

- No Private Mortgage Insurance (PMI): Unlike standard loans, physician loans often waive PMI requirements, even with a minimal down payment.

- Flexible Qualification Criteria: These loans are designed to accommodate the financial trajectory of physicians, allowing you to qualify even with substantial student debt.

- Early Access: Many lenders let you close on your loan based on an employment contract, meaning you can secure your home before starting your attending position.

These benefits make physician loans an excellent choice for residents who want to invest in their future while managing their current financial situation.

How to Qualify for a Physician Loan

To begin your homeownership journey, it’s essential to understand the qualification requirements for physician loans. While specific criteria may vary by lender, here are some common elements:

- Employment Verification: Many lenders accept a signed employment contract as proof of future income.

- Credit Score: Maintaining a good credit score will enhance your chances of approval and help secure favorable terms.

- Student Loan Treatment: Physician loans often exclude deferred student loans from the debt-to-income (DTI) calculation or use a more favorable repayment estimate.

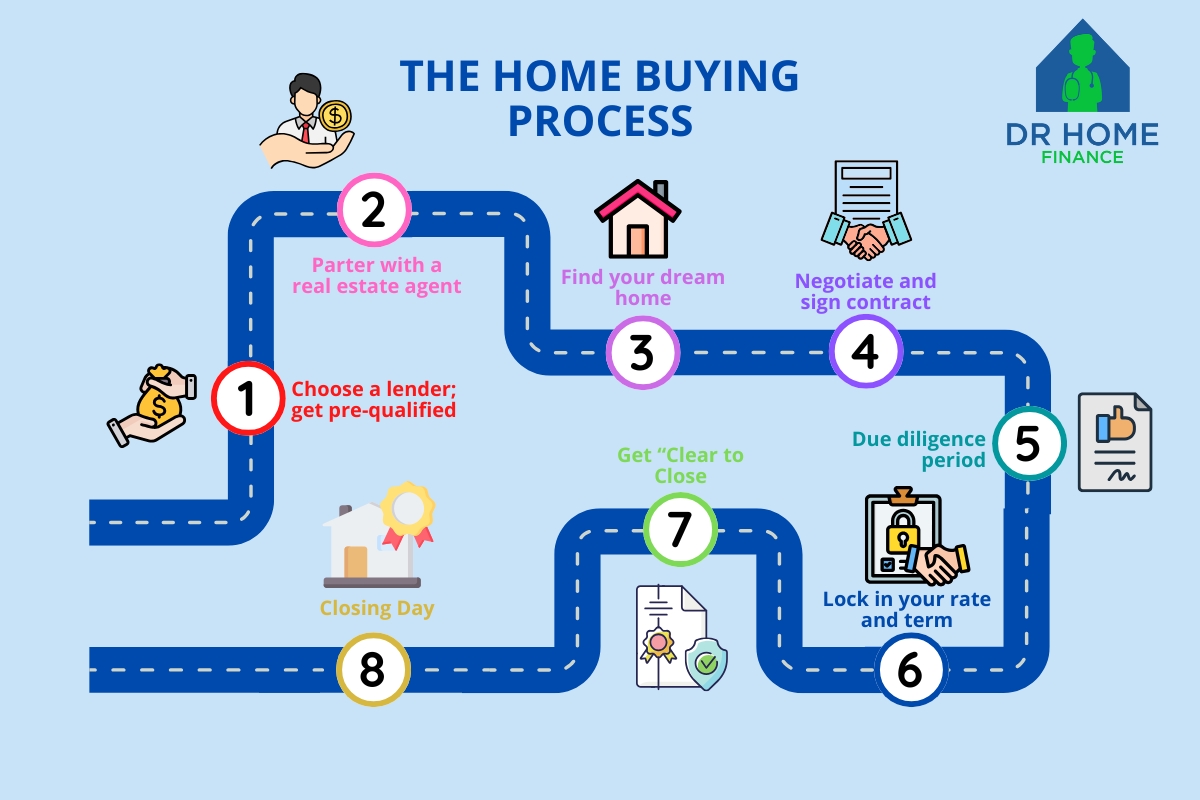

The Homebuying Process Simplified

Navigating the homebuying process as a medical professional can be overwhelming, but partnering with an experienced lender simplifies the journey. From pre-approval to closing, a lender familiar with physician loans will guide you through every step, ensuring the process is tailored to your unique needs.

Customized Mortgage Plans for Medical Professionals

Working with a lender who specializes in physician loans means you’ll receive a plan that’s personalized to your financial situation. Factors such as your student loan balance, expected income growth, and career stage are all taken into consideration. This approach ensures that your mortgage aligns with your current needs while supporting your long-term financial goals.

Expert Guidance Is Key

Medical professionals face unique challenges in the housing market, from managing student debt to navigating residency contracts. Seeking advice from mortgage lenders and financial advisors who understand these challenges is essential. These experts can help you identify the best loan programs, explain terms and interest rates, and create a repayment plan that fits your lifestyle.

Will Student Loans Impact Your Mortgage?

It’s a common concern for medical residents to wonder if their student loan debt will prevent them from qualifying for a mortgage. Fortunately, physician loans often include provisions that account for the nature of student debt among doctors. By using adjusted DTI calculations, lenders can provide more favorable terms, ensuring that student loans don’t stand in the way of your homeownership goals.

Take the Next Step

Homeownership is within reach, even during residency. Explore physician loan options tailored to your needs by partnering with a lender who understands the unique financial landscape of medical professionals. By securing a customized loan plan, you can confidently take the first step toward owning your dream home.

Ready to start your journey? Connect with our team to learn more about physician loan programs, receive expert guidance, and access the tools you need to achieve your homeownership goals.